Understanding the repayment rules of Bihar Student Credit Card Scheme (BSCC) is just as important as knowing how to apply. Many students focus only on loan approval but remain confused about EMI, moratorium period, and interest subsidy — which later creates fear and misinformation.

This guide explains BSCC repayment rules in simple language, including when repayment starts, how EMI is calculated, what moratorium period means, and how students can repay the loan without financial stress.

If you are new to BSCC, first read the complete Bihar Student Credit Card Scheme overview .

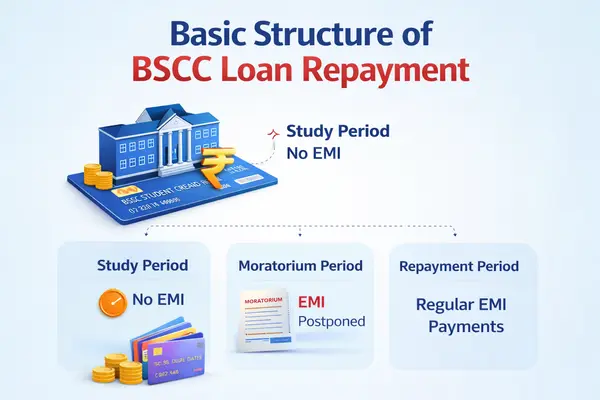

Basic Structure of BSCC Loan Repayment

BSCC is an education loan supported by the Government of Bihar. Unlike personal loans, repayment does not start immediately after loan disbursement.

- Loan amount up to ₹4,00,000

- No collateral or security

- Interest subsidy on timely repayment

- Repayment starts after course completion

What is Moratorium Period in BSCC?

The moratorium period is the time during which students are not required to pay EMIs. Under BSCC, the moratorium period includes:

- Complete course duration

- Additional grace period after course completion

This allows students to complete studies and secure employment before repayment begins.

BSCC EMI Calculation – How Much Do Students Pay?

EMI under BSCC depends on:

- Total loan amount sanctioned

- Interest rate applicable

- Repayment tenure

For example, if a student avails ₹4,00,000 loan, EMI remains student-friendly due to government interest subsidy.

Exact EMI structure is finalized by the bank after DRCC verification.

Interest Subsidy Under Bihar Student Credit Card Scheme

One of the biggest benefits of BSCC is interest subsidy. Students who repay EMIs on time receive interest support from the Government of Bihar, significantly reducing the total repayment burden.

This makes BSCC far cheaper than private education loans.

Comparison guide: BSCC vs Private Education Loan .

Role of Bank in BSCC Repayment

After DRCC verification, the partner bank sanctions the loan and manages repayment. Banks provide repayment schedule, EMI amount, and account details to students.

If repayment-related issues arise, check: BSCC bank delay and issues .

Common Doubts About BSCC Repayment

- EMI does not start during study period

- Moratorium gives time to find a job

- Late payment may affect interest subsidy

- Loan must be repaid after course completion

BSCC Repayment – Frequently Asked Questions

Q. When does BSCC repayment start?

Ans. Repayment starts after course completion and moratorium period.

Q. Is interest charged during moratorium?

Ans. Interest may accrue, but subsidy reduces the burden on timely repayment.

Q. Can EMI be delayed if I don’t get a job?

Ans. Students should contact the bank in genuine hardship cases.

For complete clarity on BSCC process, always refer to the BSCC overview page .