The Bihar Student Credit Card Scheme stands as a major step toward expanding access to higher education for students across the state. By reducing financial barriers and simplifying access to education loans, the initiative allows students to focus on academic and career growth rather than funding concerns.

Designed to support professional, technical, and general degree programs, the scheme enables learners from diverse backgrounds to pursue quality education at recognized institutions across India. Its transparent structure and government-backed support system ensure that financial assistance reaches deserving applicants efficiently.

With improved affordability, structured verification through DRCC centers, and student-friendly repayment provisions, the program strengthens trust and accessibility in education financing. As a result, it continues to empower Bihar’s youth with the opportunity to build skills, achieve career stability, and contribute meaningfully to the state’s future.

The Bihar Student Credit Card Scheme (BSCC) is a government-backed education loan scheme launched by the Government of Bihar to help students pursue higher education without financial barriers. Under this scheme, eligible students who have completed Class 12 can avail an education loan up to ₹4,00,000 for approved courses across India. The loan covers essential academic expenses such as tuition fees, hostel charges, books, and study materials.

Unlike traditional education loans, the BSCC scheme does not require collateral, making it accessible to students from diverse economic backgrounds. The application process is supported by District Registration and Counseling Centers (DRCC), which verify documents and guide applicants through the approval process to reduce errors and delays.

By improving access to higher education and reducing financial stress on families, the Bihar Student Credit Card Scheme plays a crucial role in increasing enrollment, supporting skill development, and empowering youth across Bihar.

The scheme aims to:

| Feature | Details |

|---|---|

| Maximum Loan Amount | Up to ₹4,00,000 |

| Interest Rate | 0% (Completely Interest-Free) |

| Collateral Requirement | Not required |

| Who Can Apply | Bihar residents who passed Class 12 |

| Courses Covered | Graduation, professional & technical courses |

| Eligible Institutions | Government-approved institutions across India |

| Repayment Period | 7 years (≤ ₹2 lakh) • 10 years (> ₹2 lakh) |

| Repayment Starts | After course completion & moratorium period |

| Processing System | DRCC verification + bank approval |

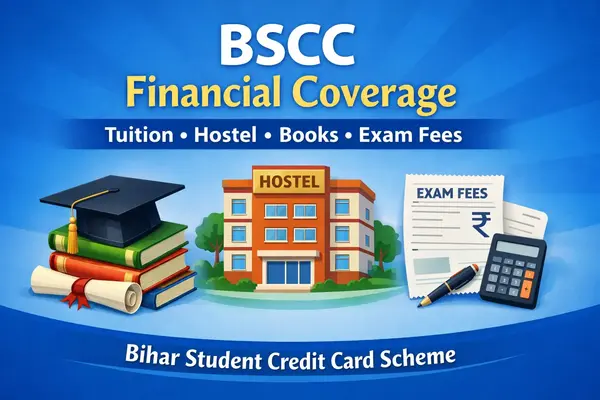

| Expenses Covered | Tuition, hostel, books, exam fees, laptop |

| Gender-Based Interest Difference | Removed (same benefit for all) |

| Purpose of Scheme | Support higher education & reduce financial barriers |

Following the landmark Bihar Cabinet decision on September 18, 2025, the Bihar Student Credit Card (BSCC) Scheme has entered its most student-centric phase. By combining a complete interest waiver with an extended repayment tenure, the state government has introduced a zero-burden education financing model aimed at ensuring that financial constraints do not prevent Bihar’s youth from pursuing higher education.

This dual reform strengthens the state’s 7 Nischay vision by enabling students to complete their education without the long-term pressure of debt.

This reform removes financial disparity and significantly improves affordability for students from all socio-economic backgrounds.

Together, these reforms improve affordability, reduce financial stress, and allow students to establish their careers before beginning repayment.

Students can understand repayment calculations and EMI structure in detail in this guide on BSCC repayment & EMI rules.

The Bihar Student Credit Card (BSCC) Scheme is designed to act as a complete financial safety net, offering a credit limit of up to ₹4,00,000 to support the entire journey of higher education. Unlike traditional education loans that often come with rigid restrictions, BSCC provides a student-friendly umbrella of financial coverage that addresses every essential academic need — from institutional fees to personal learning tools.

This comprehensive funding allows students to focus fully on their studies at recognized institutions across India without worrying about the rising costs of professional degrees. Whether pursuing a technical diploma, professional course, or advanced medical program, the financial assistance is structured to scale with individual academic requirements.

Funds provided under the scheme extend beyond tuition fees and are structured to manage the diverse expenses students face during their academic journey:

By bridging the gap between academic aspirations and financial realities, BSCC enables students to meet essential education expenses without external financial strain.

For a detailed breakdown of fund disbursement and eligible expenses, read the complete guide on BSCC financial assistance .

To ensure that the benefits of the Bihar Student Credit Card (BSCC) Scheme reach deserving candidates, the Government of Bihar has established clear and inclusive eligibility guidelines. As of 2026, these criteria support both traditional degree seekers and students pursuing specialized technical careers.

To qualify for the interest-free ₹4 Lakh education loan, applicants must fulfill the following conditions:

Eligibility requirements may vary depending on the course, institution location, or accreditation status. Use the following guides to ensure a smooth application process:

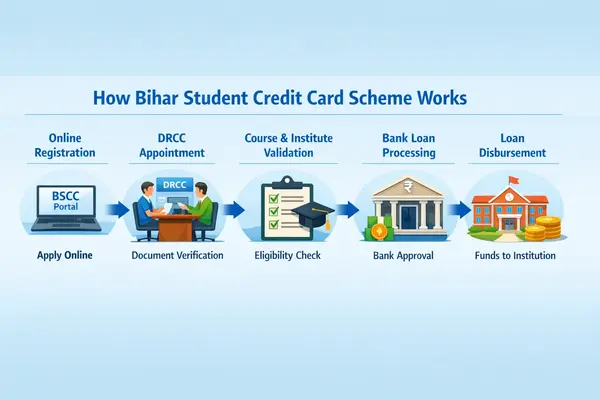

The District Registration and Counseling Centers (DRCC) serve as the backbone of the Bihar Student Credit Card Scheme (BSCC) application process. These centers act as a bridge between students, the government, and banks to ensure that applications are processed accurately and transparently.

After submitting the online application, students must visit their district DRCC for verification and guidance. This step helps prevent documentation errors, ensures the selected course and institution meet scheme guidelines, and improves the chances of timely loan approval.

By providing structured support and personalized counseling, DRCCs play a crucial role in reducing rejection rates and making the scheme more accessible, especially for first-generation learners and students from rural areas.

👉 Learn more: DRCC’s role in BSCC approval.

Applying for the Bihar Student Credit Card Scheme (BSCC) is a structured and fully digital process designed to ensure transparency and minimize delays. The application system connects students, DRCC centers, and banks through a centralized workflow.

Students can apply after securing admission in an approved course. Following the correct steps and submitting accurate documents helps avoid rejection, reduces processing time, and ensures faster loan approval.

Below is the step-by-step process every applicant must follow:

👉 Detailed walkthrough: BSCC application process

👉 Step-by-step guide: BSCC apply online guide

The Bihar Student Credit Card Scheme (BSCC) supports a wide range of higher education programs, ensuring that students from diverse academic backgrounds can continue their studies without financial barriers.

Unlike many education loan schemes that focus only on technical degrees, BSCC is designed to support professional, vocational, and general graduation programs. This flexibility allows students to choose career paths based on their interests, skills, and job market demand.

Whether you plan to pursue engineering, medical sciences, management studies, or traditional degree programs, the scheme ensures financial assistance for approved courses offered by recognized institutions across India.

👉 View full list: courses covered under BSCC

The Bihar Student Credit Card Scheme (BSCC) stands out as one of India’s most student-friendly education financing initiatives. Designed to remove financial barriers, the scheme enables students from diverse economic backgrounds to pursue higher education without depending on private lenders or high-interest loans.

By combining interest-free funding, extended repayment flexibility, and government-backed transparency, BSCC reduces financial stress on both students and their families. This support allows learners to focus on academic growth, skill development, and career readiness rather than worrying about education expenses.

For first-generation learners, rural students, and middle-income families, the scheme acts as a powerful equalizer — ensuring that talent and ambition are not limited by financial constraints.

👉 Compare options: BSCC vs scholarship differences

While the Bihar Student Credit Card Scheme (BSCC) is designed to simplify access to education financing, many applications face delays or rejection due to avoidable mistakes. Most issues arise from incomplete documentation, incorrect course selection, or missing verification steps during the approval process.

Understanding these common challenges in advance can save time, prevent unnecessary stress, and improve your chances of quick approval. Proper preparation and timely follow-ups ensure that your application moves smoothly from DRCC verification to bank sanction.

Students who stay informed and organized are far less likely to face processing delays or rejection.

If your application gets rejected or delayed, these guides can help:

Students exploring the Bihar Student Credit Card Scheme (BSCC) often have additional questions beyond eligibility and application steps. Many want clarity on choosing the right college, understanding repayment responsibilities, and comparing BSCC with other funding options.

The following guides address the most common concerns and help students make informed decisions at every stage — from admission planning to loan repayment.

Exploring these resources can help you avoid mistakes, improve approval chances, and plan your education journey with confidence.

Students frequently explore these helpful guides:

1. Is the Bihar Student Credit Card Scheme completely interest-free in 2026?

Yes. Following the landmark cabinet decision on September 18, 2025, the BSCC has transitioned into a 0% interest-free loan scheme for all students. Previously, male students were charged 4% interest and female/transgender students 1%, but these charges have now been completely waived. From the 2026 academic session onward, students are required to repay only the principal loan amount borrowed for their studies.

2. Can I use the Bihar Student Credit Card for colleges located outside of Bihar?

Yes. The BSCC scheme covers hundreds of recognized institutions across India, including education hubs such as Delhi, Bangalore, Pune, and Greater Noida. As long as the college is listed in the official approved institutions list and meets accreditation standards like NAAC or NIRF, students can use the loan to study outside Bihar.

3. What is the maximum loan amount and what expenses does it cover?

Students can avail up to ₹4,00,000 under the BSCC scheme. The loan covers tuition fees, hostel and mess charges, examination and library fees, and essential academic expenses. A portion may also be used to purchase books, study materials, and a laptop (typically capped at ₹35,000) if required for the course.

4. What is the new repayment tenure for 2026?

To reduce financial pressure on graduates, the repayment period has been extended. Loans up to ₹2,00,000 can be repaid over 7 years (84 installments), while loans above ₹2,00,000 can be repaid over 10 years (120 installments). This provides one of the most flexible repayment structures among education loan schemes in India.

5. What happens if I remain unemployed after completing my course?

The scheme includes a moratorium period consisting of the course duration plus one additional year. If a student remains unemployed after this period, they may submit an unemployment affidavit to the local DRCC. This allows temporary deferment of EMIs until the student secures employment or starts a business.

6. Is a co-applicant or collateral security required?

The BSCC is a collateral-free loan, meaning no land, property, or gold security is required. However, a parent or guardian must act as a co-applicant. The Government of Bihar acts as the guarantor, so banks cannot demand third-party guarantees or security deposits.

7. Are general courses like B.A., B.Sc., and B.Com covered?

Yes. The scheme covers more than 40 course categories, including general graduation programs such as B.A., B.Sc., and B.Com. Students must have passed Class 12 from a recognized board and be enrolled in an approved degree-granting institution.

8. What are the age limits and eligibility criteria for 2026?

Applicants must be permanent residents of Bihar and have passed Class 12 (or Class 10 for Polytechnic). The general age limit is 25 years at the time of application, with relaxations possible for certain postgraduate or professional programs. Students cannot apply for the same degree level if they have already completed one.

9. What is the role of the DRCC in the application process?

District Registration and Counseling Centers (DRCC) act as the administrative bridge between students, the government, and banks. After applying online, students must visit the DRCC for document verification. Once verified and approved, the application is forwarded to the bank for final loan sanction and disbursement.

10. Can I apply for BSCC after taking admission?

Yes. Students typically apply after securing provisional or confirmed admission. An admission letter and detailed fee structure from the institution are required. Since funds are disbursed directly to the college in installments, it is advisable to begin the application process immediately after admission confirmation.